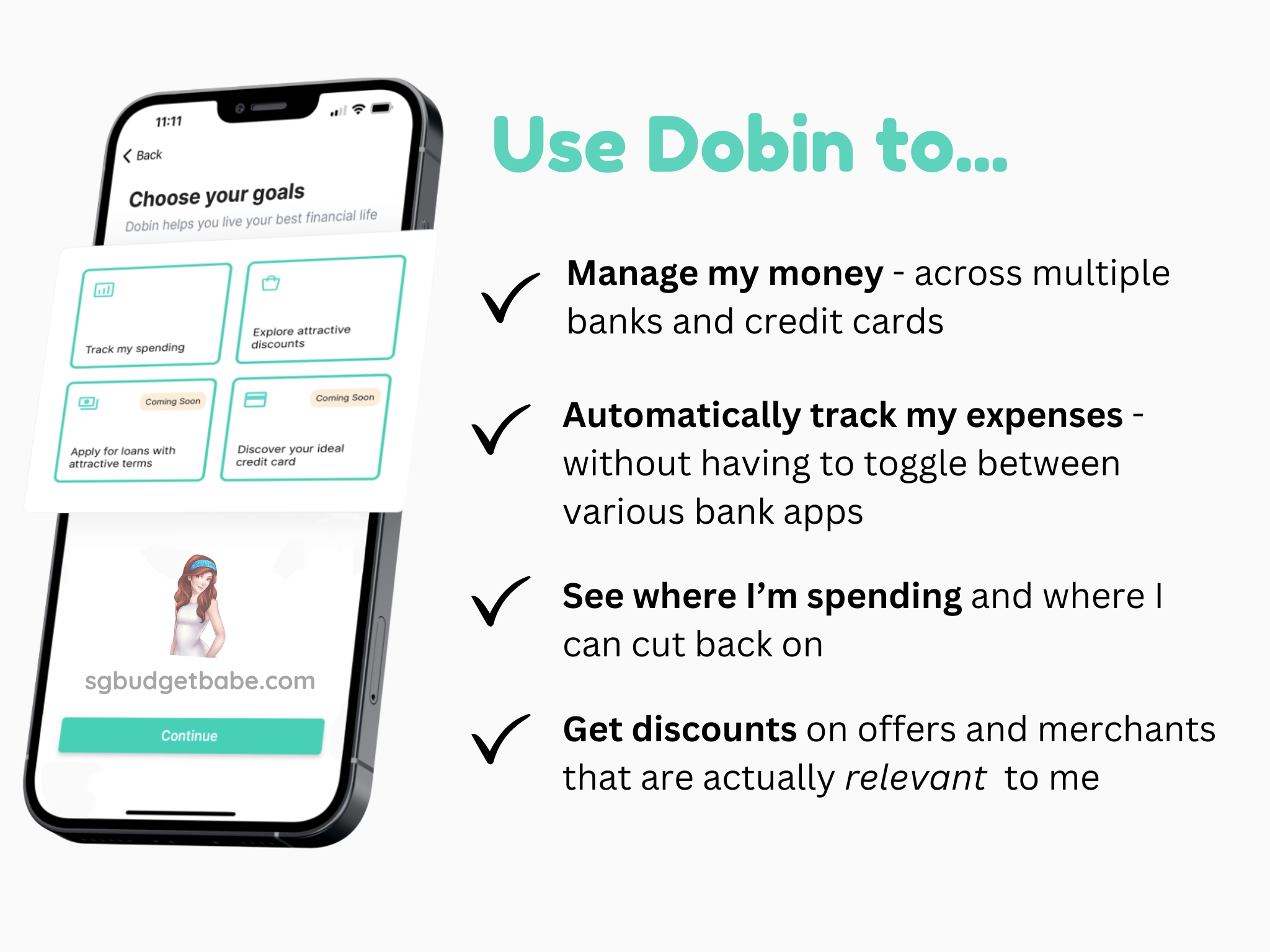

Mechanically observe and handle your bills whereas get extra rewards on what you’re already spending on. Simply depart it to Dobin! It has been a very long time since I bought this excited over a brand new finance app, particularly one which helps me to avoid wasting extra with out upselling me different investments or insurance coverage merchandise!

Managing money has turn out to be sophisticated – at the moment, most of us have a number of financial institution accounts and bank cards, but additionally cash sitting in our e-wallets (Seize / ShopeePay / amaze / Youtrip).

I don’t find out about you, however I definitely don’t fancy having to trace my money utilizing a spreadsheet. Attempting to optimize my very own bank cards and financial institution accounts for optimum bonus curiosity (leaping via all these hoops) every month is already powerful sufficient!

SGFinDex has been a welcome change, however since you possibly can solely use it by way of a financial institution or insurer’s software, the trade-offs embrace the truth that the monetary suggestions proven to us are largely to purchase extra insurance coverage merchandise or spend money on the financial institution’s robo providing. It helps me to handle my general funds however does nothing to avoid wasting any extra money or earn further rewards (that I didn’t know existed) on my present spending habits.

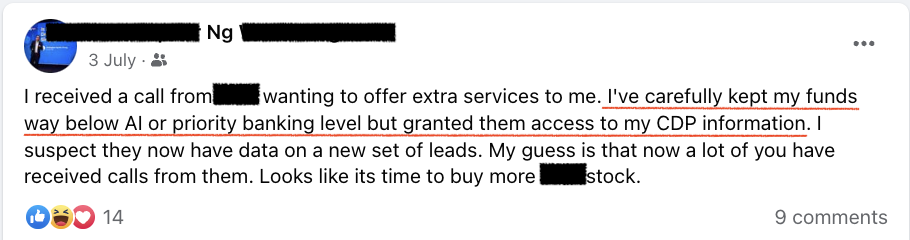

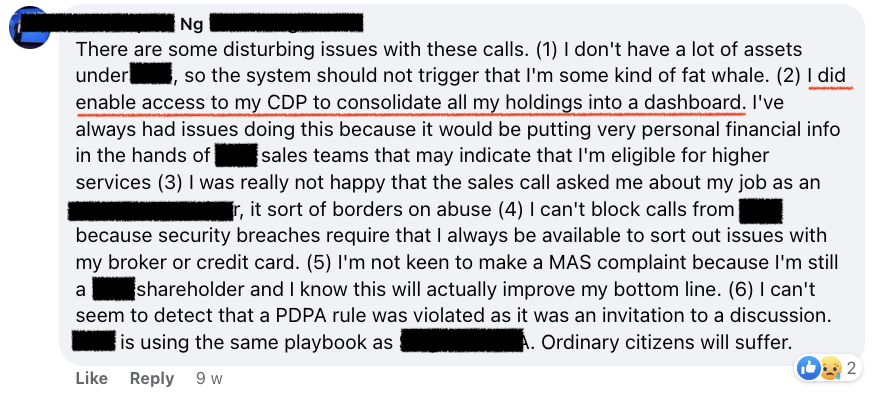

One other disadvantage is that folks have additionally began reporting unsolicited gross sales calls, now that the banks have visibility on their property held with different monetary establishments:

As a client, I don’t essentially wish to be offered extra monetary merchandise once I share my knowledge. As an alternative, I need unbiased recommendation and proposals alongside the traces of:

- Change to a different bank card – to get extra rewards in your similar spending classes!

- Procuring along with your standard retailers? Right here’s a promo code on your subsequent buy!

On the finish of the day, once I select to share my monetary knowledge, I need to have the ability to profit from it – within the type of financial savings, rewards, or how I can higher optimize my cash.

Sadly, the present market gamers on SGFinDex usually are not incentivized to assist me lower your expenses or get extra rewards as a result of it does nearly nothing for his or her backside line. Shoppers such as you and I nonetheless have to put within the effort to analysis and curate related gives for ourselves.

Right this moment, most reductions are given to incentivize additional spend, as an alternative of serving to shoppers save extra on current spend. Your financial institution can now see you are likely to spend extra on eating out, however are they utilizing that to advocate that you just change out of your present bank card (3%) to a different card of theirs that can provide you increased rewards (8%) on the identical spend? Or, if the most effective bank card for eating is actually from one other financial institution, what’s in it for them to inform you that?

Earlier this year, I wrote about my ideal version of an app that may:

- assist me handle my a number of financial institution accounts and bills, whereas utilizing that knowledge to

- curate related promotions and reductions for me.

A reader pointed me to Dobin, the place I got a sneak preview (media perks!) and I’ve been on the waitlist since. Now that it’s accessible for Android customers, right here’s my assessment!

If you wish to learn to handle your money and get essentially the most out of your rewards, then you definately’d wish to give Dobin a attempt.

Disclaimer: This assessment is sponsored by Dobin.

Handle your funds in a single app

Dobin fills a present hole available in the market, which is the necessity for an unbiased, non-FI app which may also help shoppers lower your expenses and get higher rewards on their current spending.

It additionally connects to AMEX, CIMB and Financial institution of China, which you continue to can’t get on SGFinDex.

Since its launch, I’ve been utilizing Dobin to do the next:

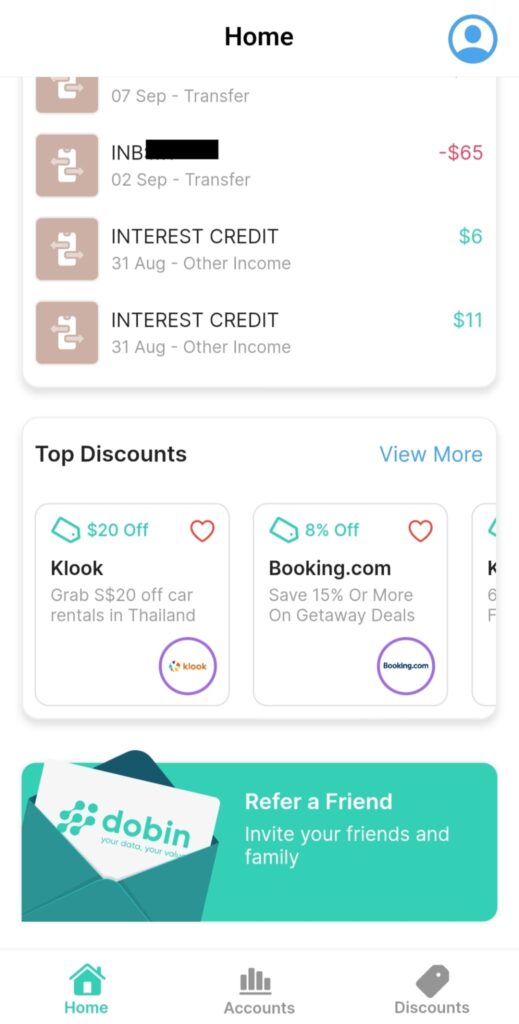

- Handle my cash throughout my a number of financial institution accounts and bank cards

- View all my latest bills in a single place (with out having to toggle between a number of financial institution apps!)

- Mechanically categorize my spending for me – so I can see how a lot I’m spending + spot ignored expenses shortly (similar to annual bank card charges that I forgot to name in to request a waiver for!)

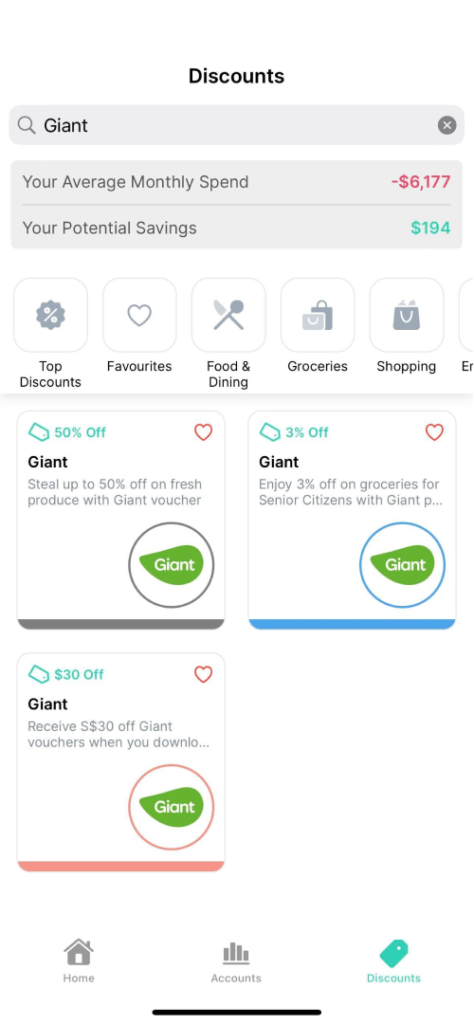

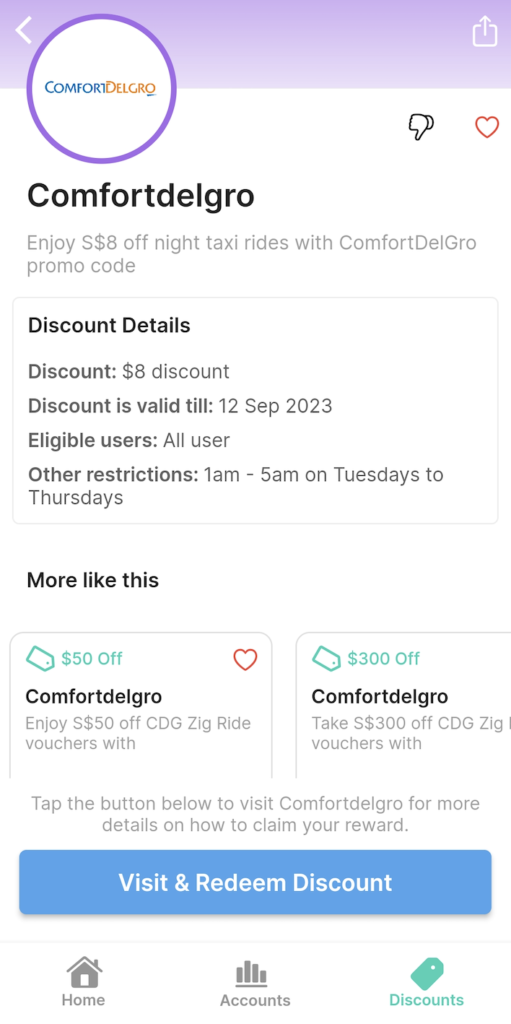

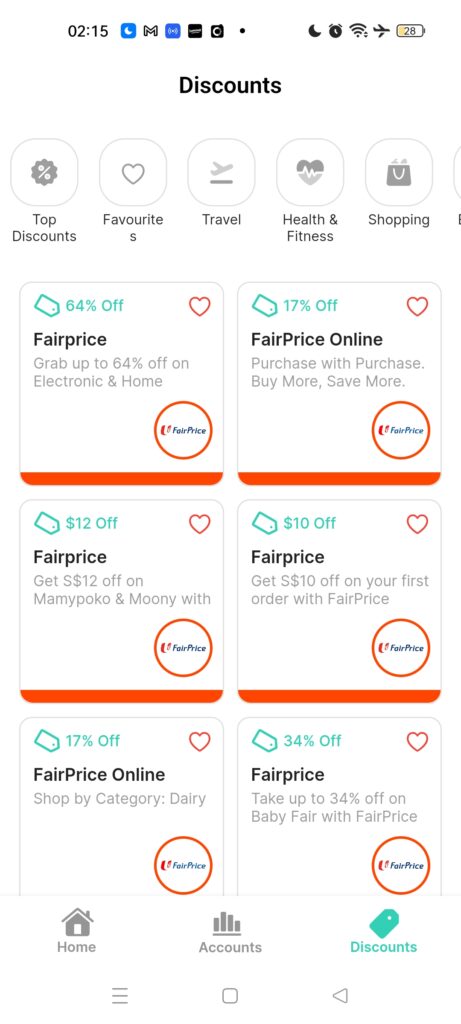

- Save time trying to find reductions related to me – it has proven me promos for Shopee, Seize, FairPrice and Big to this point (precisely the place I store at)

- (this function hasn’t been launched however is coming quickly) Level out a greater bank card to make use of for increased rewards, based mostly on our on a regular basis spend.

Let’s speak shortly about every of those advantages.

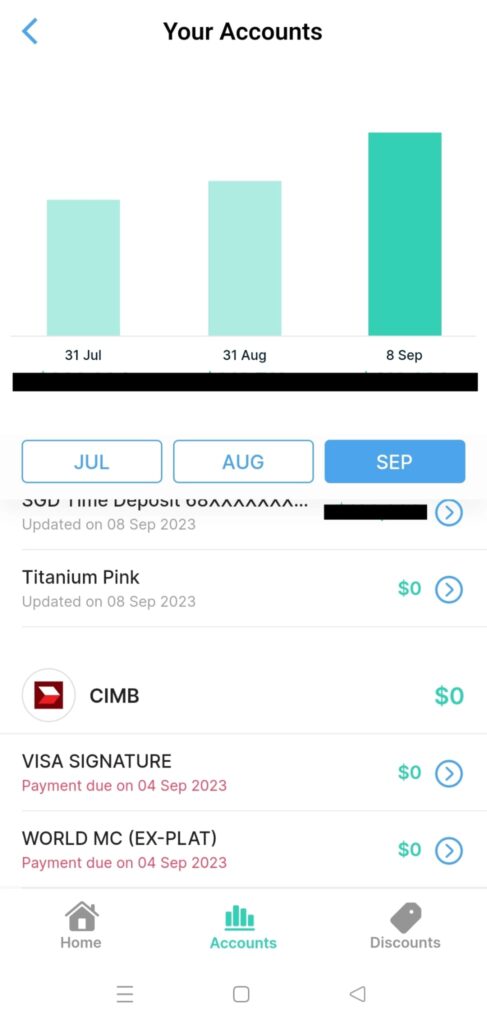

1. Handle your a number of financial institution accounts and bank cards

Proper now, the one manner for me to handle this might be to individually open up my DBS / OCBC / UOB / Customary Chartered / CIMB app to trace how a lot I’ve, what I’ve spent within the month, what I owe on my playing cards and when I have to pay.

Let me simply say this – it’s tremendous painful and tiring.

Now that I can join all of them to a single interface – Dobin – it has been a lot simpler for me to see all of my cash in a single place. And for the absent-minded people, it may possibly even flag out to you when every respective bank card invoice is due for fee.

I like it!

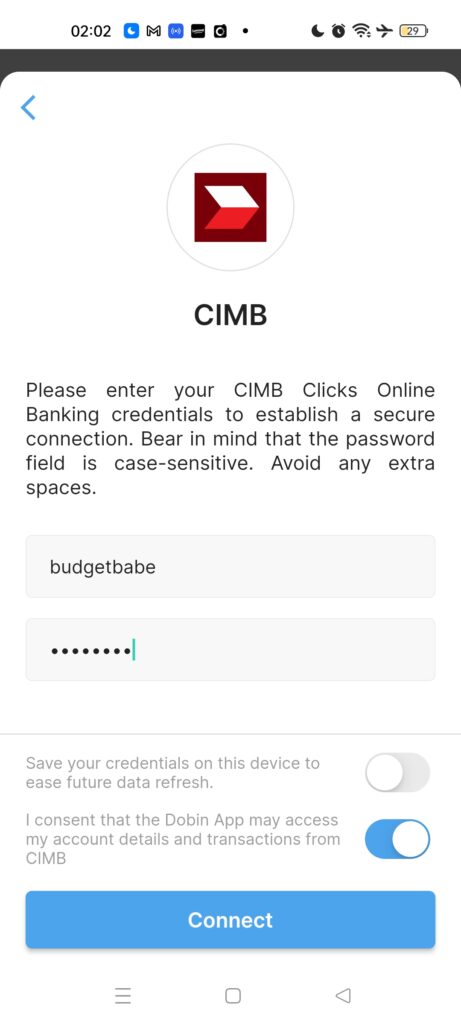

I’ve included a fast information under to indicate how the connection works, however actually, the directions on-screen needs to be fairly straightforward to observe for most individuals.

The present record of the 8 monetary establishments you possibly can hook up with Dobin are as follows: DBS, OCBC, UOB, Customary Chartered, HSBC, AMEX, CIMB and Financial institution of China.

Citibank is at the moment not accessible however might be in due time. I additionally want Dobin would additionally have the ability to see how a lot I’ve in my e-wallets (since I usually overlook about them), and I’ve already raised this as a function to be thought of for future improvement, so let’s see when it will get added!

That’s a game-changer, as a result of there’s no different app or dashboard proper now that permits you to see all of that in a single place.

2. Mechanically observe and categorize your bills

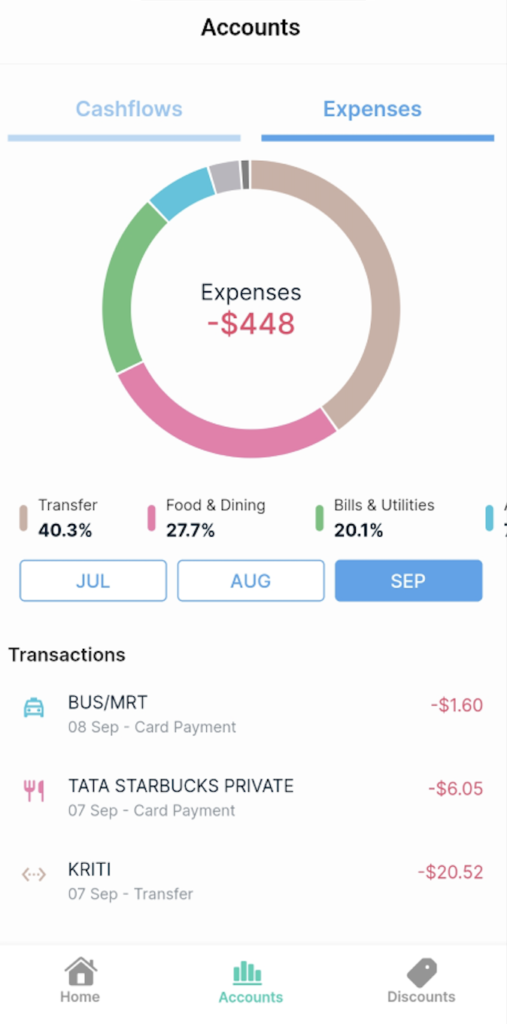

Now that every one my money will be consolidated on my Dobin dashboard, I can now observe traits in my spending and revenue, see which classes take up extra of my price range, and hone into any areas of overspending.

For anybody who cares about staying inside price range, that is actually empowering.

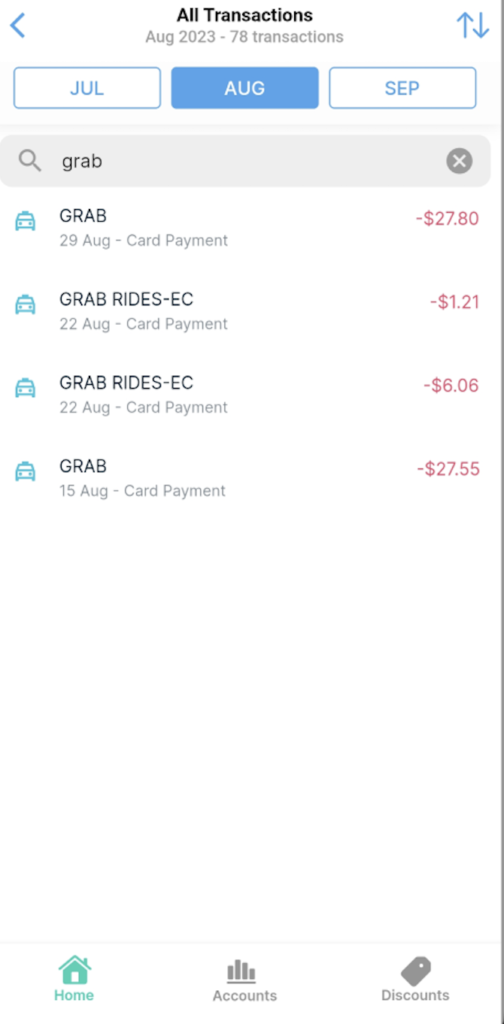

I’m particularly impressed that I can filter my transactions by trying to find particular manufacturers (e.g. Seize, Shopee) and even view month-on-month expense traits to see which transactions drove the largest change.

What’s extra, I’m certain most of you possibly can agree that it turns into simpler to overlook sure line objects or funds, as a result of a number of playing cards we should handle at the moment and all of the auto-billing preparations that we had arrange up to now.

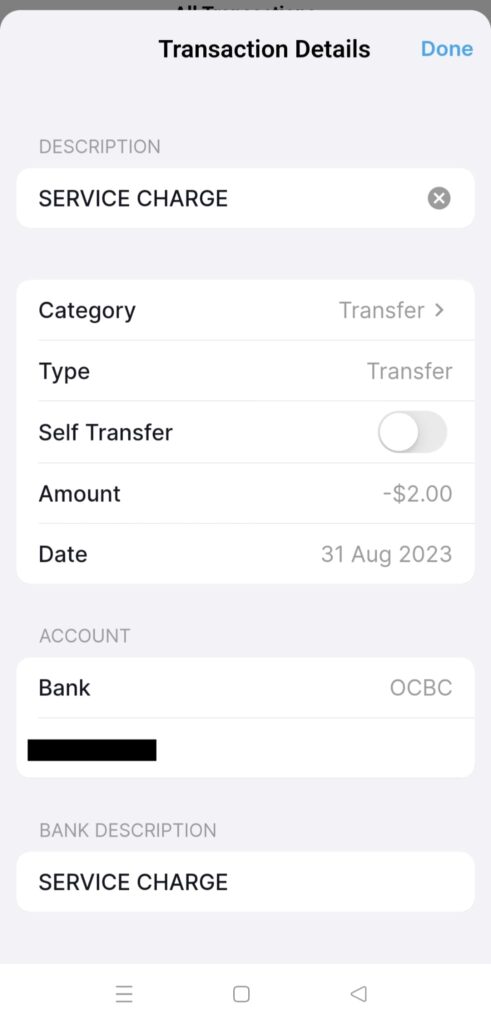

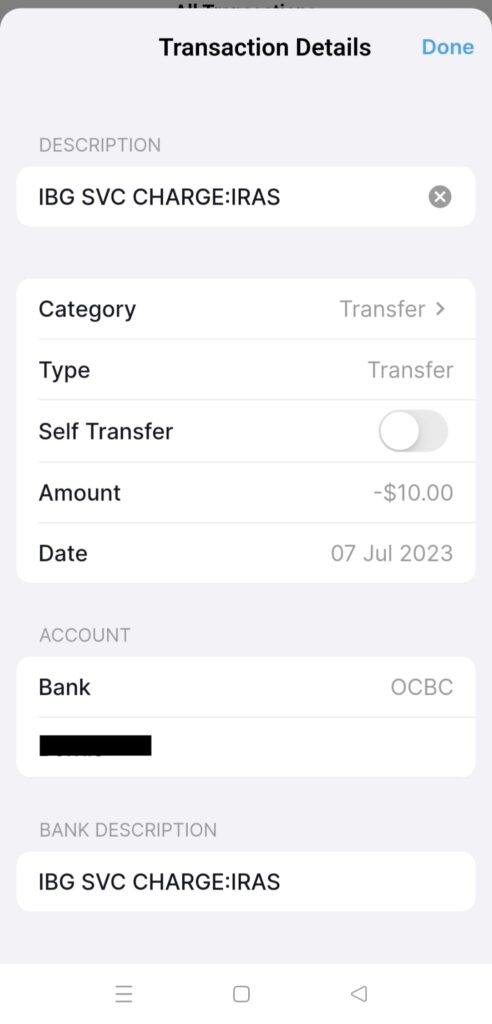

With Dobin, you need to now have the ability to spot just a few transactions that you’d in any other case have missed, similar to a late fee cost in your bank card, and even the under “service cost” charges which I by no means knew the financial institution had been deducting from my account all this whereas!

I referred to as OCBC to ask and apparently, this $10 cost is levied as a result of my GIRO fee with IRAS didn’t undergo and therefore there’s a payment. I’ve been doing this for years and by no means as soon as knew?! As loyal readers would know by now, that’s as a result of I route my revenue taxes via CardUp as a way to earn miles, which is why the GIRO association would fail since I intentionally stored inadequate funds in my designated account for paying revenue taxes.

Because of connecting every thing on Dobin, the app even helped me to establish a bank card annual payment that I had ignored final month, thus prompting me to right away give my financial institution a name to get it waived!

On my dashboard, Dobin helps me to mixture complete bills vs. financial savings vs. revenue and lets me drill down into spending by class.

Simple peasy, as a result of it’s all automated and completed for you.

You’ll have the ability to use these insights in many alternative methods – from considering of which classes you’d like to chop again on in subsequent months, and even whether or not you need to be rethinking your price range for sure stuff now that inflation-adjusted costs are right here to remain. Go experiment!

3. Get beneficial reductions

The perfect half is, I may even use this knowledge to get extra rewards on my current spend with out me having to spend unnecessarily extra.

How Dobin pulls off is:

- Once I share my knowledge with Dobin, the device returns me personalised gives which can be tailor-made to my spending. Up to now, I’ve gotten reductions for Shopee, Lazada, FairPrice and Big proven to me, that are retailers I store closely at.

- By recommending that I take advantage of one other one among my bank cards (or get a greater bank card) based mostly on my spending habits tracked. This function just isn’t launched on the time of publishing, however might be out quickly.

The app may decide up that I had simply returned from a Penang journey (given my card transactions overseas) and was thus exhibiting me journey reductions on my residence display screen. It’s also possible to search on the Reductions tab on your favorite service provider to see if any promotion is being listed!

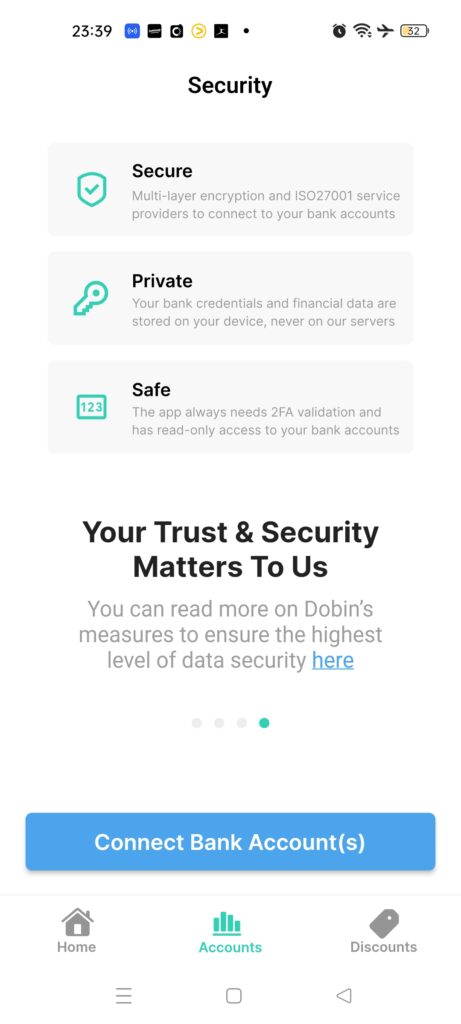

How protected is my knowledge on Dobin?

Okay, so the app is all nice and helpful, however…how protected is it, actually?

In mild of all of the elevated rip-off circumstances, you possibly can think about how I used to be naturally skeptical about keying in my usernames and passwords into Dobin to permit for the syncing of information.

Nevertheless, the identical steps are wanted for SGFinDex anyway, so I understood why this was needed. That is additionally the place – upon enquiring – the Dobin group assured me that their entry is “read-only”, which suggests Dobin can solely view data and will be unable to ship any directions to the consumer’s checking account (e.g. can’t withdraw or switch cash in your behalf).

For the tech geeks, how this works is that your consumer credentials are by no means saved on Dobin’s servers; as an alternative, they’re encrypted and saved by yourself machine password administration system similar to Apple Keychain or Android Keystore.

What’s extra, it’s as much as you whether or not you wish to save your credentials on the machine to ease future knowledge refresh everytime you log into Dobin subsequently. In case you choose to not, then you definately’ll merely need to re-connect every time you open up your Dobin app – which shouldn’t be an enormous challenge in alternate for the peace of thoughts that you just get, I assume.

You’ll be able to read about Dobin’s data privacy and security controls here. What I took away was that my banking credentials are by no means despatched to Dobin’s servers i.e. the app doesn’t retailer any delicate or private data similar to addresses, fee data or card particulars. As an alternative, the information goes from my financial institution to my cell phone, and stays there i.e. it isn’t shared with the Dobin back-end platform, except I explicitly determine to share with Dobin – wherein case my knowledge will get anonymized earlier than sharing.

You additionally received’t have to fret about receiving unsolicited gross sales calls out of your financial institution reps to upsell you any funding merchandise anymore, since your knowledge isn’t shared with them nor their relationship managers once you use Dobin!

TLDR Conclusion

To sum it up, it’s possible you’ll discover totally different advantages out of your monetary knowledge dashboard on Dobin vs. the worth I personally bought out of it, however for me what I appreciated essentially the most are the next options:

- It helps me to see all my bank card fee due dates in a single place. Now there’s no extra excuse to overlook a invoice or incur late charges once more!

- Dobin helped me to spot expenses and transactions that I didn’t even know I had been paying for, such because the $10 service cost charges for my revenue tax to IRAS

- It robotically categorizes my transactions into classes for me, that are fairly correct – I’ve not spot any errors I needed to manually appropriate to this point. This enables me to grasp the place my cash goes, and do stuff like guarantee my eating bills doesn’t exceed 30% every month if I wish to keep inside price range.

- I may even search by service provider to see how a lot I’ve been paying…and even overspending e.g. I’m definitely responsible of getting spent on too many Seize rides this month as a result of my tighter schedule.

As somebody who cares about staying inside price range and never overspending, a lot much less paying for “avoidable” charges like late expenses or bank card curiosity, I actually recognize the quantity of thought that has gone into constructing Dobin and making it one that actually serves the patron’s wants.

Proper now, the app is free to make use of, so go forward and try it out!

In case you have a number of financial institution accounts and bank cards like I do, it’s possible you’ll wish to begin by syncing your most commonly-used playing cards and spending accounts first.

And when you don’t wish to sync sure financial institution accounts (maybe as a result of your secret wealth is stashed away there), you possibly can select to not.

That manner, you get to benefit from the insights and analytics that Dobin can provide, whereas benefiting from the personalised reductions and promotions proven to you based mostly on what you’re already spending on.

Save extra and get larger rewards.

How does that sound?

Strive it out for your self by downloading Dobin at the moment!

For iOS users, you can download it here. Android customers, get Dobin here on the Google Play Store.

Disclosure: This text is written in collaboration with Dobin.